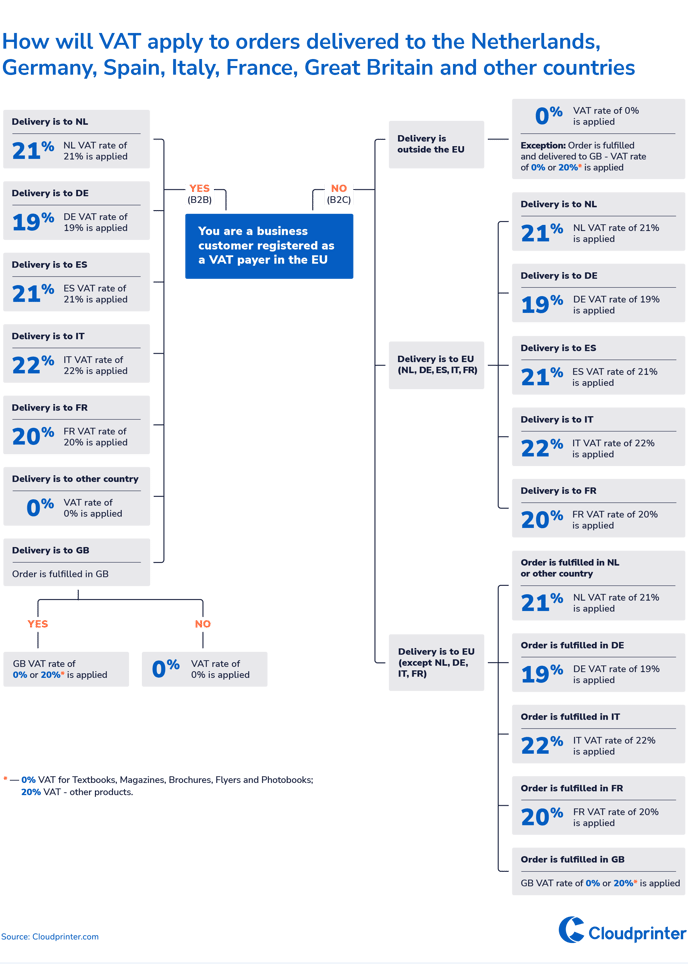

If you're a European or outside the EU business customer registered as a VAT payer in the European Union and:

- delivery is to NL — NL VAT rate of 21% is applied;

- delivery is to DE — DE VAT rate of 19% is applied;

- delivery is to ES — ES VAT rate of 21% is applied;

- delivery is to IT — IT VAT rate of 22% is applied;

- delivery is to FR — FR VAT rate of 20% is applied;

- delivery is to GB: if the order is fulfilled in GB — GB VAT rate of 0% or 20%* is applied and if the order is fulfilled in other country — VAT rate of 0% is applied;

- delivery is to other country — VAT rate of 0% is applied.

If you're a European or outside the EU business customer not registered as a VAT payer in European Union or individual consumer:

- the order is fulfilled in NL or other country — NL VAT rate of 21% is applied;

- the order is fulfilled in DE — DE VAT rate of 19% is applied;

- the order is fulfilled in IT — IT VAT rate of 22% is applied;

- the order is fulfilled in FR — FR VAT rate of 20% is applied;

- the order is fulfilled in GB — GB VAT rate of 0% or 20%* is applied.

- delivery is to NL — NL VAT rate of 21% is applied;

- delivery is to DE — DE VAT rate of 19% is applied;

- delivery is to ES — ES VAT rate of 21% is applied;

- delivery is to IT — IT VAT rate of 22% is applied;

- delivery is to FR — FR VAT rate of 20% is applied.

- VAT rate of 0% is applied.

Exception - Order is fulfilled and delivered to GB - VAT rate of 0% or 20%* is applied.

* 0% VAT for Textbooks, Magazines, Brochures, Flyers and Photobooks; 20% VAT - other products.

We calculate VAT with the following formula: (Cloudprinter product price + shipping)*VAT rate

The exact VAT rate depends on several criteria, such as:

- whether you're a registered VAT payer;

- where your business is registered as a VAT payer;

- where Cloudprinter is registered;

- where the order is shipped;

- who organizes transport for the delivery of goods.

Download the scheme of Cloupdprinter’s global VAT handling approach.